How to Register as Self-Employed in the UK: The 2025 Guide

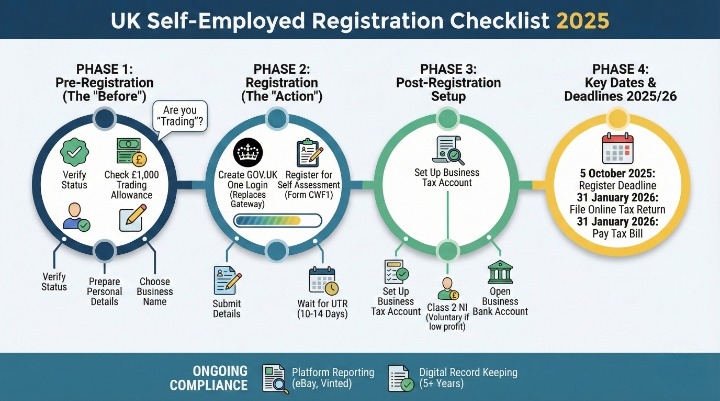

The rules for becoming your own boss have changed. If you are looking to register as self employed UK 2025, you aren’t just facing the usual forms. You are navigating new “side hustle” reporting rules, a shift in digital ID systems, and updated National Insurance thresholds.

Most guides will tell you to “just get a UTR number.” That advice is outdated.

In 2025, digital platforms like Vinted and eBay are legally required to report your earnings to HMRC. The line between a hobby and a business has never been sharper. Whether you are a freelance graphic designer, a tradesperson, or an online reseller, getting your registration right from day one is the only way to avoid the “Failure to Notify” penalty.

This guide walks you through the exact checklist for the 2025/26 tax year, cutting through the jargon to keep you compliant and penalty-free.

Step 1: Check If You Actually Need to Register

Before you fill out a single form, you need to confirm legally if you are “trading.” HMRC does not require everyone who makes extra money to register.

The £1,000 Trading Allowance

The UK government offers a tax-free “trading allowance” of £1,000 per tax year (6 April to 5 April).

-

Gross Income < £1,000: If your total sales (before expenses) are under £1,000, you generally do not need to register or pay tax. You don’t even need to tell HMRC.

-

Gross Income > £1,000: You must register for Self Assessment.

The Accountant’s Note:

Be careful with the definition of “Gross Income.” If you sell £1,500 worth of goods but spend £600 on postage and stock, your profit is £900, but your gross income is £1,500. Because the gross income exceeds the allowance, you must register, even though your profit is low.

Side Hustles vs. Hobbies (The “Badge of Trade”)

This is the biggest source of anxiety for 2025. Does selling on Vinted make you self-employed?

The LITRG Trading Allowance guide clarifies this using the “Badges of Trade.”

-

Scenario A (Not Trading): You clear out your attic and sell your old winter coats on Vinted for £1,200. You sold personal items for less than you bought them for. There is no profit motive. Result: No registration needed.

-

Scenario B (Trading): You go to charity shops, buy vintage coats for £10 each, and resell them on Depop for £50 each. You made £1,200 total. You bought items with the intent to sell for profit. Result: You must register.

Step 2: Gather Your Information (The “Pre-Flight” Check)

Once you confirm you are trading, get your data ready. The online session times out quickly, so have these details on your desk before you start.

Personal Details Required

-

National Insurance (NI) Number: You cannot register without this. If you have lost it, check your payslips or the HMRC App.

-

Date of Birth: Must match your NI records exactly.

-

Residential Address: This is for HMRC correspondence.

-

Date You Started Trading: This can be in the past. Be honest. This date determines when your first tax return is due.

Choosing a Business Name

You can trade under your own name (e.g., “Sarah Jones”) or a business name (e.g., “SJ Creative”).

If you choose a business name, you must follow strict rules:

-

No “Limited”: You cannot use “Ltd,” “Limited,” or “LLP” unless you actually incorporate a company.

-

Sensitive Words: You cannot use words that suggest a connection to the government or a royal family (e.g., “British,” “Royal,” “Commission”) without special permission.

-

Trademarks: Check the UK Intellectual Property Office to ensure you aren’t infringing on an existing brand.

Step 3: The Registration Process (Updated for 2025)

The technology behind HMRC is changing. While older guides mention the “Government Gateway,” 2025 sees the rollout of GOV.UK One Login.

1. Create Your Digital Account

Go to the [HMRC Registration Page].

-

Existing Users: If you already have a Government Gateway ID (from a personal tax account or checking your driving license), sign in with that.

-

New Users: You may be prompted to create a GOV.UK One Login. This is the new, single way to access government services. You will need a photo ID (passport or driving license) and a smartphone to scan your face for identity verification.

2. Submit the CWF1 Form (Register for Self Assessment)

Once logged in, select “Add a tax to your account” and choose Self Assessment.

You are technically submitting form CWF1. You will enter the business details you gathered in Step 2.

-

Business Description: Keep it simple but accurate. E.g., “Freelance Graphic Designer” or “Online Retailer of Vintage Clothing.”

-

Contact Details: Ensure your email is current; HMRC sends digital nudges here.

3. Wait for Your UTR Number

After submitting, HMRC will generate your Unique Taxpayer Reference (UTR). This is a 10-digit number that stays with you for life, like your NI number.

Pro Tip:

HMRC says to wait 10–14 days for the letter to arrive by post. However, your UTR often appears in the HMRC App or your online Business Tax Account (BTA) within 48 hours. Download the app and keep checking to get a head start.

Step 4: Your Tax Responsibilities (Income Tax & NI)

Registering is only the first step. You now have two main costs to budget for: Income Tax and National Insurance.

Income Tax Bands (2025/26)

You pay tax only on your profit (Income minus allowable expenses).

| Band | Taxable Income | Tax Rate |

| Personal Allowance | Up to £12,570 | 0% |

| Basic Rate | £12,571 to £50,270 | 20% |

| Higher Rate | £50,271 to £125,140 | 40% |

| Additional Rate | Over £125,140 | 45% |

National Insurance Changes (Class 2 & Class 4)

This area changed significantly in April 2024, affecting all 2025 returns.

-

Class 2 NI: This used to be a mandatory weekly flat rate. It is now effectively abolished for most traders with profits over £12,570.

-

The Trap: If your profits are below £6,725, you do not pay Class 2 NI, but this creates a gap in your National Insurance record. You may want to make voluntary Class 2 payments (approx. £3.45/week) to ensure the year counts toward your State Pension. You tick a box on your tax return to do this.

-

-

Class 4 NI: You pay this on profits between £12,570 and £50,270 (rate is usually 6%) and a lower rate on profits above that.

Critical Dates & Deadlines for 2025

Missing a deadline is the easiest way to lose money. Mark these in your calendar immediately.

-

5 October 2025: The absolute deadline to register if you started trading between 6 April 2024 and 5 April 2025.

-

Missed it? You risk a “Failure to Notify” penalty.

-

-

31 January 2026: Deadline to file your online tax return for the 24/25 tax year.

-

31 January 2026: Deadline to pay any tax you owe.

The Penalty Structure

HMRC penalties are tiered.

-

Late Filing: £100 instant fine if you are one day late (even if you owe no tax).

-

Failure to Notify: If you didn’t register by October 5th and can’t pay your tax by January, the penalty is tax-geared. It can be up to 100% of the tax due if HMRC believes you deliberately concealed income (common with undisclosed side hustles).

FAQs

Do I need to register if I earn less than £1,000?

No. If your gross trading income is under £1,000 in a tax year, you are covered by the Trading Allowance. You do not need to register or file a return.

What happens if I miss the October 5 deadline?

Register as soon as possible. If you register late but still file your return and pay your tax by 31 January, HMRC typically waives the “Failure to Notify” penalty. The real danger is missing the January payment deadline.

Can I register as self-employed while employed (PAYE)?

Yes. Many people are “hybrid” workers. You will pay tax on your self-employed profits, and HMRC will calculate this by looking at your total income (salary + freelance profits) to determine your tax band.

How long does it take to get a UTR number in 2025?

Allow 10 to 15 working days for the letter. However, checking your Personal Tax Account online or via the HMRC App is often faster.

Is Class 2 National Insurance abolished for self-employed people?

It is abolished as a mandatory cost for those earning over the Small Profits Threshold. However, it still exists as a voluntary option for low earners who want to protect their State Pension entitlement.

Do I need a business bank account as a sole trader?

Legally, no. You can use your personal account. Practically, you should open one. Keeping business transactions separate makes doing your taxes significantly easier and proves to HMRC that you are running a professional operation.

Does HMRC check Vinted and eBay accounts?

Yes. Under OECD rules adopted by the UK, digital platforms must report the income of sellers who make more than €2,000 (approx £1,700) or complete 30 or more sales in a year. If you hit these triggers, HMRC receives your data automatically.

Summary

Registering as self-employed in the UK for 2025 requires more than just filling out a form. It demands awareness of your “trading” status, a handle on the new National Insurance rules, and strict adherence to the October 5th deadline.

Recap Checklist:

-

Check: Does your income exceed the £1,000 allowance?

-

Register: Use GOV.UK One Login or Gateway to submit form CWF1.

-

Wait: Get your UTR number (save it securely).

-

Record: Track every penny of income and expense from Day 1.

Registration is just the start line. The real work is maintaining accurate records so that when January rolls around, you are ready to file with confidence.

Ready to start? Go to the Official GOV.UK Registration Page now to create your account. Once you are set up, check out our [Guide to Self-Employed Expenses to ensure you don’t pay a penny more tax than you need to.