National Grid Collapse 2026? Fact-Checking the Blackout Warnings

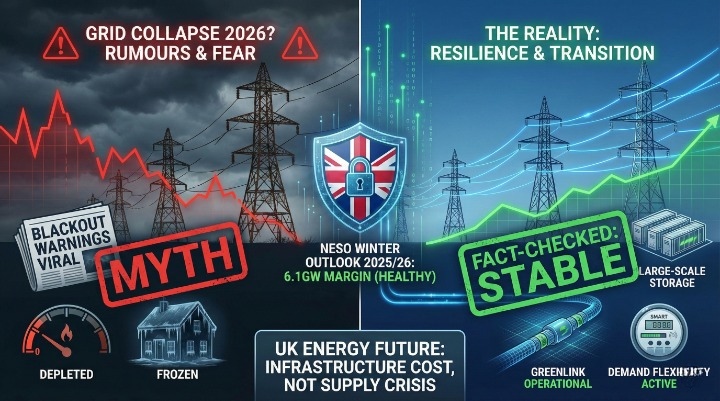

You have likely seen the videos circulating on TikTok or X (formerly Twitter). The captions are alarming. They warn of a “national grid collapse 2026” or claim the UK is sleepwalking into a permanent blackout.

It is easy to see why these theories gain traction. Energy bills remain stubbornly high, and the weather seems more volatile every year. But when you strip away the social media noise and look at the actual engineering data, a different picture emerges.

The UK energy system is not collapsing. It is, however, undergoing the most expensive and complex “rewiring” in its history.

This article cuts through the panic. We will look at the official data from the National Energy System Operator (NESO), the real risks posed by North Sea gas decline, and why your bills are rising in April 2026 even as wholesale gas prices stabilise.

Is a National Grid Collapse Likely in 2026?

Let’s address the primary fear immediately. Is the grid going to fail?

According to the official NESO Winter Outlook 2025/26, the answer is no.

In fact, the electricity supply margin, the “buffer” of spare power available during peak demand, is currently healthier than it has been for years. The Outlook report confirms a de-rated margin of 6.1GW (roughly 10%) for this winter period. This is the highest capacity buffer the UK has seen in six years.

Why the sudden improvement? Two factors are doing the heavy lifting:

-

The Greenlink Interconnector: This newly operational subsea cable connects the UK grid to Ireland, allowing for rapid import of wind power when our own generation dips.

-

Battery Storage Boom: The UK now has record operational battery storage. These giant lithium-ion banks store excess solar and wind energy during the day and discharge it instantly during the evening peak (5 pm – 7 pm).

[NESO Winter Outlook 2025/26 Full Report]

Expert Insight: “A ‘collapse’ implies a total structural failure. What we actually face are ‘tight periods.’ These are managed events, not accidents. The grid has never been smarter at balancing itself than it is right now.”

Fact vs. Fiction: The 2026 Grid Myths

| The Rumour | The Reality (Data-Backed) |

| “The grid will collapse in 2026.” | False. Margins are at a 6-year high (6.1GW). |

| “We are running out of electricity.” | False. We have enough capacity; the challenge is moving it (transmission constraints). |

| “Blackouts are guaranteed.” | Unlikely. NESO predicts a “Loss of Load Expectation” of just 0.1 hours per year. |

| “Renewables make the grid unstable.” | Nuanced. They are variable, but battery storage and interconnectors now balance this variability. |

The Real “Cliff-Edge”: North Sea Gas and Pipeline Risks

While the electricity grid is robust, the gas network faces a genuine and serious challenge in 2026. This is where the “collapse” rumours often originate, though they usually get the details wrong.

The North Sea Transition Authority (NSTA) has released data showing UK gas production is on track to halve by 2030. We are currently seeing the steepest part of that decline.

The risk here isn’t running out of gas globally. The risk is infrastructure viability.

A December 2025 report by energy consultancy Watt-Logic highlighted a “cliff-edge” scenario for ageing pipelines. As the volume of gas flowing through these massive North Sea pipes drops, they become uneconomical to maintain. If a major terminal closes early because flow rates drop below a safety threshold, the UK loses a key supply route overnight.

This forces the UK to rely more heavily on Liquefied Natural Gas (LNG) imports from the US and Qatar. While this keeps the lights on, it leaves us exposed to volatile global prices and weather delays.

[NSTA Gas Production Forecasts]

Energy Price Cap 2026: Why Bills are Rising (Hint: It’s Not the Gas)

If gas prices are relatively stable, why are analysts forecasting a rise in household bills for April 2026?

Ofgem set the January 2026 price cap at £1,758 for a typical household. However, widely respected forecasts from Cornwall Insight predict a jump to approximately £1,815 in April.

This increase is frustrating because it has nothing to do with the cost of the fuel itself. It is about the “non-commodity costs” hidden on your bill.

The Hidden Levies on Your Bill

-

Nuclear RAB (Regulated Asset Base): You are now paying a small levy to fund the construction of the Sizewell C nuclear plant. This “pay as you build” model adds to bills now to supposedly lower them in the 2030s.

-

TNUoS Charges: Transmission Network Use of System charges are rising. This is the cost of building new pylons and cables to connect offshore wind farms to the grid.

The Digital Marketer’s Energy Audit:

As someone who runs a home office, I track these “standing charge” increases closely. The unit rate (price per kWh) might look stable, but the daily standing charge is creeping up to cover these infrastructure projects.

Pro Tip: Check your bill for the “standing charge” line item. If you are a low user, a tariff with a high standing charge but low unit rate is bad news. Look for “zero standing charge” tariffs if you have solar panels or low usage.

Grid Blackout Risks: What Happens During “Tight Periods”?

You might see headlines in 2026 about “Capacity Market Notices” (CMNs). It is vital not to panic when these appear.

A Capacity Market Notice is an automated alert issued by the grid control room. It triggers when the buffer between supply and demand drops below a certain safety threshold (usually 500MW).

It does not mean a blackout is starting.

It is simply a signal to the market. It tells generators (like gas plants or coal standby units) to warm up because the grid might need them in four hours. In almost every case, the market responds, extra power comes online, and the notice is cancelled without a single home losing power.

The Demand Flexibility Service (DFS)

The grid has a new weapon against blackouts: you.

The Demand Flexibility Service is now a permanent fixture for 2026. This scheme pays households and businesses to shift their usage away from peak times (usually 5 pm to 6 pm).

Instead of forcing a blackout, the grid now essentially “bribes” us to turn off the washing machine for an hour. In previous winters, this saved over 3GW of power, equivalent to a nuclear power station. If you have a smart meter, participating in these sessions is the easiest way to lower your bill and help grid stability.

Scrapped: The Zonal Pricing Decision

Throughout 2024 and 2025, there was intense debate about introducing Zonal Pricing. This would have split the UK into different energy price zones. People living near wind farms in Scotland would pay less, while those in high-demand London would pay more.

However, in July 2025, the government officially shelved this plan under the Review of Electricity Market Arrangements (REMA).

What this means for you:

-

You will not face a “postcode lottery” for electricity prices in 2026.

-

The national pricing structure remains.

-

This provides certainty for businesses but means we miss out on the efficiency of local pricing.

Future-Proofing: How to Protect Your Home & Business

We know a “national grid collapse 2026” is unlikely. But high prices and “tight” grid days are here to stay. Reliance on the grid is becoming expensive.

Here is how smart homeowners and small businesses are adapting in 2026:

1. Smart Tariffs & Time-of-Use

Standard variable tariffs are a money pit. Smart tariffs (like Octopus Agile or similar) track wholesale prices every half hour. By moving energy-intensive tasks (EV charging, dishwashing) to cheap slots, you avoid the peak pricing that hits everyone else.

2. “Behind-the-Meter” Storage

Businesses are no longer waiting for grid upgrades. Many SMEs are installing commercial battery storage systems behind their meter. This allows them to buy cheap power at night, store it, and run their business off the battery during the expensive day rates. It also acts as a UPS (Uninterruptible Power Supply) if a local power cut does occur.

3. Solar “Over-Sizing”

With export rates (Smart Export Guarantee) rising, installing more solar panels than you strictly need is becoming a smart investment. You generate your own power and sell the excess to the grid during those “tight periods” we discussed earlier.

Summary

The headlines about a national grid collapse 2026 are driven more by anxiety than analysis. The data from NESO shows a grid that is stronger and more resilient than it was three years ago, bolstered by new interconnectors and battery storage.

However, the “energy crisis” hasn’t ended; it has just changed shape. We have moved from a crisis of scarcity (not enough gas) to a crisis of infrastructure cost (paying for the transition).

Your lights will stay on in 2026. But the cost of keeping them on will include the price of rebuilding the system for a Net Zero future.

Take Action: Don’t wait for April. Review your tariff now, check if you are eligible for the Demand Flexibility Service, and consider if battery storage could insulate you from the rising standing charges.

FAQs

Will there be blackouts in the UK in 2026?

Total blackouts are highly unlikely. The National Energy System Operator (NESO) reports a healthy 6.1GW supply margin for the 2025/26 winter. While “tight days” may trigger automated alerts, the grid has sufficient tools to manage them.

Why is the energy price cap rising in April 2026?

The forecast rise to ~£1,815 is largely due to “non-commodity” costs. These include levies to fund the new Sizewell C nuclear plant and network charges (TNUoS) for upgrading the grid infrastructure.

Is the National Grid running out of gas?

The UK isn’t “running out” of gas, but domestic production from the North Sea is declining rapidly. This forces us to import more LNG, which puts pressure on the pipelines and makes prices more volatile.

What is the Nuclear RAB levy on my bill?

The Regulated Asset Base (RAB) levy is a small charge added to bills to help fund the construction of new nuclear power stations like Sizewell C while they are being built, rather than waiting until they are operational.

What is a Capacity Market Notice?

It is an automated warning issued by the grid to electricity generators when the buffer between supply and demand gets tight (usually below 500MW). It signals generators to create more power; it does not mean a power cut is happening.

Did the UK switch to zonal pricing?

No. In July 2025, the UK government decided against introducing zonal pricing (different prices for different regions). The UK retains a single national price for wholesale electricity.

Is the UK still importing energy from France and Norway?

Yes, and even more than before. New interconnectors, like the Greenlink cable to Ireland and Viking Link to Denmark, allow the UK to import and export vast amounts of green energy instantly.