Small Business Energy Grants UK: 2025 Eligibility & 2026 Funding Outlook

“Free money” for business energy upgrades is disappearing. If you are reading this hoping for a generic “government handout” to pay for your entire solar array, you might be disappointed.

But if you are looking for smart funding—tax breaks, subsidized loans, and specific technology vouchers, the opportunities in late 2025 are actually better than they were a year ago.

Most business owners are stuck looking at outdated advice. They are still searching for the “Industrial Energy Transformation Fund” (which has closed its main window) or the “Energy Bill Discount Scheme” (which ended back in 2024).

This guide cuts through the noise. We will clarify Small business energy grants UK 2025 eligibility, expose the “dead end” schemes you should stop Googling, and explain why the upcoming April 2026 tax changes mean you need to act now.

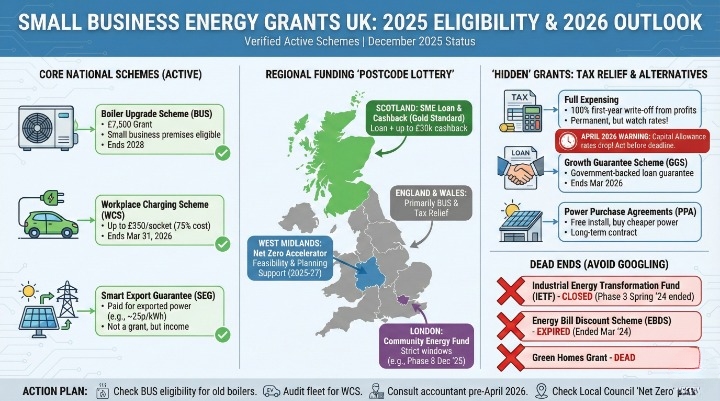

The Core National Schemes: What’s Open Now?

If you are based in England or Wales, the landscape for direct cash grants is competitive. The days of broad “green business grants” are gone. They have been replaced by targeted incentives for specific technologies: heat pumps, electric vehicles (EVs), and solar export.

Boiler Upgrade Scheme (BUS): The £7,500 Opportunity

This is currently the heavyweight champion of energy grants. While often marketed to homeowners, small businesses are eligible under specific conditions.

-

The Offer: A flat grant of £7,500 towards the cost of an air source heat pump or ground source heat pump. Biomass boilers are also eligible in limited off-gas grid circumstances (£5,000 grant).

-

Status: Confirmed active until 2028.

-

Eligibility Criteria:

-

You must own the building (or have permission from the owner).

-

The property must have an Energy Performance Certificate (EPC) with no outstanding recommendations for loft or cavity wall insulation.

-

The total installation capacity must not exceed 45kWth (suitable for most small offices, shops, and cafes).

-

💡 Experience Pro-Tip: The “120-Day Rule” catches many applicants out. Your installer must apply for the voucher before commissioning the system. Once the voucher is issued, you have strictly 120 days to complete the work and submit the paperwork. If you miss this deadline, the voucher expires, and you go to the back of the queue.

[Check if your property is eligible on GOV.UK]

Workplace Charging Scheme (WCS)

If you have a fleet or want to offer EV charging to staff, this is a no-brainer. Unlike other schemes that fluctuate, this has remained stable, though the funding pot is reviewed annually.

-

The Offer: The government covers 75% of the purchase and installation costs of EV charge points.

-

Cap: Up to £350 per socket, limited to 40 sockets per business.

-

2025 Status: Active until March 31, 2026.

-

Eligibility: You must be a registered business, charity, or public sector organization and have dedicated off-street parking.

This is a voucher-based system. You apply online, get a unique code, and give it to your OZEV-authorized installer. Do not book an installer who isn’t authorized; they cannot claim the grant for you.

Smart Export Guarantee (SEG): Earning, Not Granting

This isn’t a grant upfront, but it is a critical subsidy for ROI (Return on Investment). If you install solar PV, you shouldn’t just give your excess energy back to the grid for free.

Under SEG regulations, energy suppliers with more than 150,000 customers must offer you a tariff for the electricity you export.

-

The Reality Check: In 2023, some tariffs were as low as 2p/kWh.

-

The 2025 Shift: Competition has heated up. As of December 2025, top-tier tariffs from providers like Octopus Energy or Good Energy are offering 20p – 25p per kWh.

-

Eligibility: Your installation must be MCS certified. Without an MCS certificate (Microgeneration Certification Scheme), you cannot access these rates.

Regional Funding: The “Postcode Lottery”

This is where the real value often hides. National schemes get the headlines, but local councils hold the purse strings for smaller, “quick win” grants.

The availability of Small business energy grants UK 2025 eligibility depends heavily on your location.

Scotland: The “SME Loan & Cashback” (Gold Standard)

If your business is in Scotland, you are in the best position in the UK. The Scottish Government, through Business Energy Scotland, offers a package that England simply doesn’t match.

-

The Deal: An interest-free loan up to £100,000 to pay for energy efficiency measures.

-

The “Grant” Element: You can receive cashback of up to £30,000 (subject to available funding). This means you don’t pay back that portion of the loan.

-

Eligible Tech: Heating, insulation, double glazing, and LED lighting.

West Midlands: Net Zero Accelerator

For businesses in Birmingham, Coventry, and Wolverhampton, the Net Zero Accelerator is currently in Phase 2 (active 2025-2027). This program focuses on planning. They often fund energy audits and feasibility studies, which are expensive prerequisites for larger bank loans.

London: Community Energy Fund

The Mayor of London’s fund has strict windows. We are currently approaching the deadline for Phase 8 (December 7, 2025). If you miss this, look out for Phase 9 in early 2026. This is primarily for community businesses and social enterprises looking to install solar or retrofits.

⚠️ Warning: Never pay an upfront fee to a “grant finding agency.” Official regional grants are free to apply for. If someone asks for £500 to “unlock” a government grant, it is likely a scam.

The “Hidden” Grants: Tax Relief & Capital Allowances

Most business owners want a cheque in the post. But a reduction in your Corporation Tax bill is mathematically identical to a grant—and often much easier to claim.

Full Expensing (The 100% Write-off)

“Full Expensing” became permanent in recent budgets. It allows companies to deduct 100% of the cost of qualifying plant and machinery from their profits before tax.

-

How it works: If you spend £50,000 on new solar panels, you deduct £50,000 from your taxable profit.

-

The Benefit: At the current Corporation Tax rate of 25%, this saves you £12,500 in tax. That is effectively a 25% discount funded by HMRC.

The April 2026 Warning (Act Fast)

This is the most critical part of this guide.

Current fiscal forecasts indicate changes to the Annual Investment Allowance (AIA) and writing-down allowances starting April 2026. Specifically, the special rate pool writing-down allowance is projected to drop from 18% to 6% for certain long-life assets if specific “sunset clauses” aren’t extended.

Even more urgent is the First Year Allowance (FYA) for electric vehicle charge points. This 100% allowance is currently set to end on 31 March 2026 (for Corporation Tax) and 5 April 2026 (for Income Tax).

The Strategy: If you are planning a major capex project (like a solar carport or a new HVAC system), verify your purchase orders and installation dates before March 31, 2026. Waiting until the new financial year could cost you thousands in delayed tax relief.

Alternatives When Grants Aren’t Available

Sometimes, you just won’t be eligible. Your turnover might be too high, or you rent your premises. Here are the viable “Plan B” options.

Growth Guarantee Scheme (GGS)

Successor to the Recovery Loan Scheme (RLS), the Growth Guarantee Scheme is active until March 31, 2026.

-

What is it? It is not free money. It is a government-backed 70% guarantee to the lender.

-

Why use it? If your bank refuses a commercial loan for “risky” green upgrades (like unproven battery storage tech), the GGS gives the bank the confidence to say “yes.”

-

Terms: Loans up to £2 million.

Power Purchase Agreements (PPA)

If you have a large roof but zero cash, a PPA is the solution.

-

A funder pays for and installs solar panels on your roof (Cost to you: £0).

-

You agree to buy the electricity generated by those panels at a fixed rate (e.g., 15p/kWh) for 15-20 years.

-

This rate is usually significantly lower than the grid price (e.g., 28p/kWh).

You get cheaper energy and green credentials without spending a penny on hardware.

Dead Ends: Schemes You Should Stop Googling

To save you time, here is a list of schemes that often appear in search results but are closed or irrelevant for small businesses in late 2025.

-

Industrial Energy Transformation Fund (IETF): The Phase 3 Spring window closed in April 2024. The Autumn window was cancelled. Even when active, the minimum grant was £100,000, aimed at factories and data centers, not high-street SMEs.

-

Energy Bill Discount Scheme (EBDS): This replaced the Energy Bill Relief Scheme and officially ended on March 31, 2024. There is currently no universal government cap on business energy unit rates.

-

Green Homes Grant: Long dead. Do not click on ads promising this for your business premises.

FAQs

Can I get a grant for solar panels in England in 2025?

Direct grants for solar panels are rare for English SMEs. The government prefers to support solar through the Smart Export Guarantee (SEG) (paying you for power) and Full Expensing (tax relief). Scotland still offers loan/cashback options.

Is the Boiler Upgrade Scheme available for businesses?

Yes, if the business property meets the criteria (small capacity under 45kWth). It is ideal for small offices or B&Bs. It is not suitable for large industrial heating.

What is the deadline for the Workplace Charging Scheme?

The current extension runs until March 31, 2026. However, funding is allocated in tranches, so it is safer to apply sooner rather than waiting for the deadline.

How does the “Growth Guarantee Scheme” work?

You apply via an accredited lender (like Barclays, Lloyds, or challenger banks). The government provides a guarantee to the bank, not you. This allows the bank to offer you better terms or approve a loan they would otherwise reject.

Are there grants for LED lighting in 2025?

Generally, no. LED lighting pays for itself so quickly (usually <2 years) that the government no longer subsidizes it directly. However, you can use Capital Allowances to offset the cost against tax.

What is the difference between CAPEX and OPEX funding?

CAPEX (Capital Expenditure) funding covers the cost of buying the equipment (e.g., the BUS grant). OPEX (Operating Expenditure) funding helps with running costs. Most 2025 grants focus on CAPEX.

Can charities apply for the Boiler Upgrade Scheme?

Yes, charities are eligible provided they own the building and meet the EPC requirements.

Summary: Your 2025 Action Plan

Navigating Small business energy grants UK 2025 eligibility requires a shift in mindset. The government has moved away from “free cash for everyone” toward “support for specific technologies.”

Here is your immediate checklist:

-

Check your heating: If you have an old gas boiler, the £7,500 BUS grant is your best bet.

-

Audit your fleet: Use the Workplace Charging Scheme before March 2026.

-

Talk to your accountant: Ensure any big purchases land before the April 2026 tax changes.

-

Look local: Check your specific council’s website for “Net Zero” funds—they often have pots of money that national searches miss.

Do not wait for a perfect “free money” scheme to appear. The cost of inaction—via high energy bills and missed tax relief—is higher than the cost of upgrading.