Student Council Tax Exemption Process UK: Avoid £1,500+ Bills (2026)

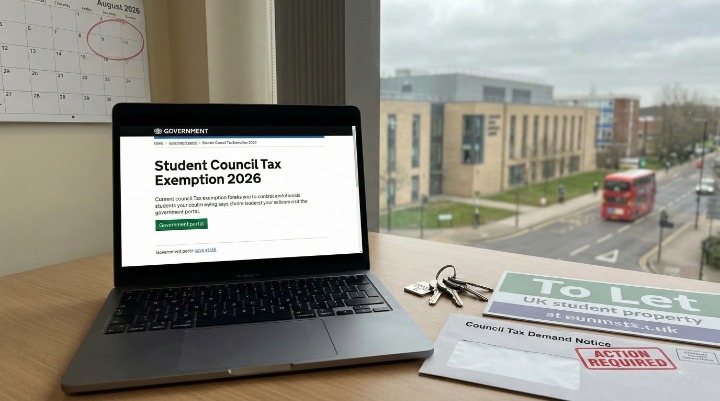

Imagine the relief. You just secured a university place through Clearing in August. You find a room, unpack your boxes, and start Freshers’ Week. Then, a letter arrives from the local council demanding £1,500 for the year.

This scenario is far too common. For the 2026 academic year, rising living costs mean every pound counts. Understanding the student council tax exemption process UK isn’t just paperwork; it’s a critical financial shield.

Many students assume the exemption is automatic. It isn’t. If you live in a private rental, you must actively prove your status. This guide breaks down exactly how to claim your council tax disregard and provides a survival strategy for finding late student accommodation if you are applying through Clearing.

Are You Actually Exempt? The “Full-Time Student” Test (2026 Rules)

Before you fill out any forms, you need to know if you meet the legal definition of a “full-time student.” The rules here are strict.

The 21/24 Standard for Higher Education

According to GOV.UK (2025), you only qualify for a council tax exemption if your course meets two specific criteria:

- It lasts for at least one calendar or academic year.

- It requires you to undertake at least 21 hours of study per week for at least 24 weeks a year.

[Check your Council Tax student eligibility on GOV.UK]

If you are studying part-time, you do not qualify for the student exemption. You will likely have to pay the full bill unless you qualify for other benefits like Council Tax Reduction based on low income.

PhD Students, “Writing Up”, and Gap Years

This is where many postgraduates get caught out.

- Writing Up: If you are a PhD student in your “writing up” phase, you generally remain exempt provided you are still enrolled at the university. However, rules vary by council. Some local authorities may require a specific letter from your supervisor confirming active study.

- Intercalated/Gap Years: If you suspend your studies or take a formal gap year, you are technically not a student for council tax purposes during that period. You will be liable for tax until you officially re-enroll.

- International Students and Non-British Dependants

International students with a Tier 4 or Student Visa follow the same 21/24 rule. But what about your family?

According to the UK Council for International Student Affairs (UKCISA, 2026), if you have a non-British spouse or dependant living with you, they are often “disregarded” for council tax purposes if their visa conditions prevent them from:

- Taking paid employment.

- Claiming public funds.

[UKCISA guidance on dependants and Council Tax]

This means your household could still be 100% exempt. Always check the specific wording on your partner’s visa vignette before applying.

The Step-by-Step Council Tax Exemption Process in the UK

You know you are eligible. Now you need to prove it. Do not wait for the bill to arrive. Follow this roadmap the week you move in.

Step 1: Securing Your “Council Tax Student Certificate”

Your university does not send this to the council for you automatically in most cases. You must generate it yourself.

- Log in to your university student portal (e.g., MyCampus, e-Vision, or Student Records).

- Look for a tab labeled “Documents,” “Letters,” or “Proof of Status.”

- Select “Council Tax Exemption Letter” or “Student Status Certificate.”

- Download the PDF. It must show your course start date, course end date, and full-time status.

Pro-Tip: Your student ID card is not valid proof for the council. Sending a photo of your ID will only delay your application and could result in a court summons for non-payment.

Step 2: Automation vs. Manual Application

Some forward-thinking councils (like Birmingham City Council and Glasgow City Council) have data-sharing agreements with local universities. When you register at uni, you might see a box asking if you want to “Opt-in to Council Tax data sharing.”

- If you ticked yes: The university sends your name to the council. You still need to register your address with the council, but the exemption should apply faster.

- If you ticked no (or your council doesn’t do this): You must go to your local council’s website, find the “Apply for a Discount or Exemption” section, and upload the certificate you downloaded in Step 1.

[Find your local council website]

Step 3: The Joint Tenancy Liability Trap

This is the most dangerous pitfall for students in private housing. If you sign a “Joint and Several” tenancy agreement, you are all collectively responsible for the bills.

If everyone in the house is a full-time student, the bill is £0.00.

If one person drops out or isn’t a student, the exemption for the property is lost.

| Household Composition | Council Tax Liability | Who Pays? |

| All Full-Time Students | 100% Exempt | Nobody pays. |

| Students + 1 Non-Student | 25% Discount | The non-student is liable for 75% of the bill. |

| Students + 2 Non-Students | 0% Discount | The full bill is due. |

The Risk: If you live with a non-student, you (the student) cannot be legally pursued for the council tax bill. The non-student is solely liable. However, landlords often unknowingly pressure students to contribute. Know your rights: students are invisible for council tax calculations.

Finding Student Accommodation Late: The Clearing 2026 Survival Strategy

The student council tax exemption process UK is only relevant if you actually have a place to live. If you are applying via UCAS Clearing in July or August 2026, finding a room is a race against time.

UCAS Clearing 2026: Critical Dates & Deadlines

Clearing officially opens on July 5, 2026, but the scramble begins on A-Level Results Day (August 13, 2026).

- The Problem: Most university-owned halls allocate rooms in June. By August, they are often full.

- The Fix: Immediately contact the university’s accommodation office. Even if they say “full,” ask to be put on the waiting list. Cancellations happen daily in late August as students switch courses or defer.

Purpose-Built Student Accommodation (PBSA) vs. Private Rentals

If university halls are full, look at Purpose-Built Student Accommodation (PBSA). These are private blocks (like Unite Students, iQ, or Student Roost) that function like halls but are privately owned.

- Why use them for Clearing? They often have “Clearing Availability” specifically held back for late applicants.

- Booking Speed: Unlike private landlords who need viewings and references, PBSA providers often allow you to book a room online instantly with a guarantor.

The “Right to Rent” Check for International Students

If you are an international student searching late, landlords are legally required to check your immigration status before handing over keys.

- Mistake: Arriving for a viewing without documents.

- Solution: Have your Share Code generated from the GOV.UK website ready on your phone. This proves your right to rent instantly.

[Prove your right to rent to a landlord – GOV.UK]

Common Mistake: Many students panic and transfer money to “landlords” on Facebook Marketplace without viewing the room. Never pay a deposit for a property you haven’t seen, or that hasn’t been verified by a university housing list. Scams peak in August.

Shared Houses: Who Pays What?

Moving into a private house share often complicates the tax situation.

The “Single Person Discount” (25% Reduction)

If you move in with a professional (someone who works full-time), the house stops being fully exempt. Because you (the student) are “disregarded,” the council treats the professional as if they are living alone.

- The Result: The household gets a 25% “Single Person Discount.”

- The Cost: The professional must pay the remaining 75%. You should not split this bill. The tax liability sits legally with the non-student.

- Houses in Multiple Occupation (HMO) Liability

In a large shared house (usually 5+ people) classed as an HMO, the council tax liability usually falls on the landlord, not the tenants.

- Check Your Contract: The landlord will pay the council directly, but they might increase your rent to cover the cost. According to Shelter (2025), if your rent includes bills, ensure the contract states clearly that council tax is included.

[Shelter UK – Who pays council tax?]

UK Student Housing FAQs

Do I have to pay council tax during the summer holidays?

No. As long as you are enrolled for the next academic year (e.g., moving from Year 1 to Year 2), your exemption continues through the summer.

When does my student status officially end?

Your exemption ends on the official course completion date listed on your student certificate, not your graduation ceremony date. Liability usually begins the day after your course ends.

What if I withdraw from my course halfway through the year?

You become liable for council tax immediately from the date of withdrawal. You must inform the council straight away to avoid building up debt.

Can I get an exemption if I live with my parents?

If you live with two parents, there is no exemption for the house. However, if you live with only one parent, they can claim the 25% Single Person Discount because you are disregarded.

Is a student status certificate the same as a student ID?

No. A student ID proves identity. A status certificate proves legal eligibility under the Local Government Finance Act.

How do I find private student halls late in the year?

Use specialized search engines like Student.com, Casita, or Mystudenthalls. Filter by “Immediate Availability” or “Semester Lets.”

What is a guarantor service for international students?

Most private landlords require a UK-based guarantor (someone who pays rent if you don’t). If you don’t have one, services like Housing Hand or YourGuarantor can act as your guarantor for a fee.

Summary

Navigating the student council tax exemption process UK requires proactive administration. The system will not help you automatically; you must demand your exemption.

Takeaways for 2026:

- Download your certificate the day you enroll.

- Apply online with your local council immediately after moving in.

- Check your liability if you live with non-students.

- Start Clearing searches early and use PBSA providers for safer, faster booking.

Don’t let a lack of paperwork cost you thousands. If you are unsure about your contract or tax status, contact your university’s Student Union advice center immediately. They offer free, independent legal checks to keep your budget safe.