Standing Order vs Direct Debit: The Definitive 2025 Guide for UK Bill Payers

I used to think they were the same. Then, in one week, I had to change my fixed rent payment and dispute my variable mobile phone bill. I quickly learned that the type of payment I’d set up—a standing order vs. a direct debit—made all the difference in who had the control.

For millions in the UK, this confusion isn’t just academic; it’s the difference between financial control and costly mistakes, especially in a high cost-of-living environment. Using the wrong one can lead to failed payments, bank fees, or even being in arrears on a critical bill. This guide explains the difference between a standing order and a direct debit for good.

In this guide, we’ll go beyond simple definitions. We will cover the key differences, the pros and cons, and crucially, your consumer rights. We’ll also expose the third type of payment—the Continuous Payment Authority (CPA)—that causes the most confusion. By the end, you’ll know exactly which payment to use, when, and how to manage it safely.

Standing Order vs Direct Debit: Key Differences at a Glance

The easiest way to see the difference between a standing order and a direct debit is to compare them side-by-side.

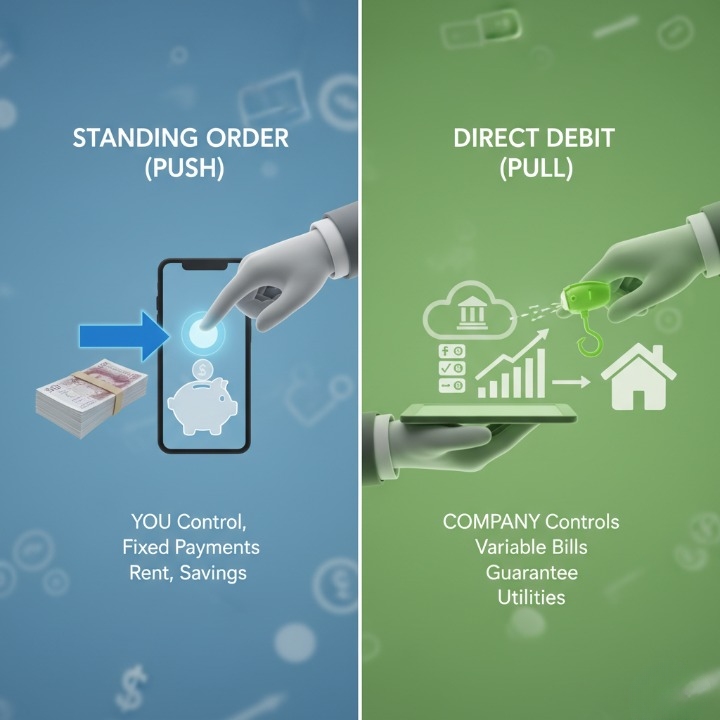

What is a Standing Order? The ‘Push’ Payment You Control

Think of a standing order as a ‘push’ payment. It’s a simple, fixed instruction you give to your bank.

How Standing Orders Work

You are telling your bank, “Send £X to Sort Code Y and Account Number Z on this specific day every month.” You set the amount, the date, and the recipient. You are the only one who can change it.

The UK’s government-backed MoneyHelper service confirms a standing order is a regular payment you set up yourself for a fixed amount. [MoneyHelper guide to standing orders]

Pros and Cons of Standing Orders

[Note: Use 'Pro' and 'Con' sub-bullets for readability.]

-

Pros:

-

Total Control: You set the amount and date. No one can change it but you.

-

Simple: Easy to set up a standing order and cancel via your digital banking app.

-

Reliable: Great for predictable, fixed payments.

-

-

Cons:

-

Inflexible: If a bill changes, you must manually update the standing order.

-

No Protection: If you make a mistake (e.g., wrong account number or pay the wrong person), your bank doesn’t have to refund you.

-

Risk of Underpayment: Forgetting to update it for a price change can lead to you falling behind on bills.

-

Common Use Cases for Standing Orders

-

Paying monthly rent to a private landlord.

-

Regularly moving money into your own savings account (e.g., to an ISA).

-

Fixed monthly payments to family members or friends.

The Common Standing Order Pitfall (My Experience)

Avoid This Mistake: I set a standing order for my council tax. When the new financial year started, the bill increased by £8, but my standing order didn’t. I underpaid for two months and received a warning letter.

Lesson: Use a Direct Debit for any bill that can change, even if it’s only once a year.

What is a Direct Debit? The ‘Pull’ Payment You Authorise

A Direct Debit is a ‘pull’ payment. This is the key difference. It’s an authorisation (a ‘payment mandate’) you give to a company, allowing them to pull money from your account when a payment is due.

How Direct Debits Work (The ‘Payment Mandate’)

You don’t set this up with your bank. You set it up with the company you’re paying. By completing a ‘Direct Debit Mandate’ (that online form where you enter your sort code and account number), you are giving that company permission to collect payments.

This is part of the official Bacs payment system, which is managed by Pay.UK.

Key Features: Variable Payments and Advance Notice

This is the Direct Debit’s superpower: it allows the company to take variable payments. This is why it’s perfect for utility bills that change each month.

But you are still protected. The company must give you ‘advance notice’ (usually 10 working days) of any change to the amount or collection date. This gives you time to check the bill and query it if something looks wrong.

Pros and Cons of Direct Debits

-

Pros:

-

Flexible: It automatically handles variable bills. You never have to update the amount.

-

Convenient: It’s the ultimate ‘set and forget’ for all your household bills.

-

Full Protection: You are completely protected by the Direct Debit Guarantee.

-

-

Cons:

-

Less Direct Control: The company initiates the payment, which can feel worrying at first.

-

Errors Can Happen: A company can make a mistake (though it’s rare), which is stressful. However, this is easily and immediately correctable.

-

Common Use Cases for Direct Debits

-

Utility bills (gas, electric, water)

-

Household bills (council tax, mobile phone, broadband)

-

Monthly subscriptions (gym, insurance, streaming services, car finance)

Your Unbeatable Protection: The Direct Debit Guarantee Explained

This section is critical. The Direct Debit Guarantee is one of the strongest consumer rights protections in UK banking. It is the single biggest reason to use Direct Debits for all your bills.

What is the Direct Debit Guarantee?

This is the core of your protection. It’s a set of rules that makes the bank, not you, responsible if an error is made.

The official scheme, run by Pay.UK, states that if an error is made in a Direct Debit payment by the company or the bank, you are entitled to a full and immediate refund of the amount paid. [The Direct Debit Guarantee on Pay.UK]

The Guarantee in Plain English:

If a payment is taken for the wrong amount…

If a payment is taken on the wrong date…

If a payment is taken after you cancelled the mandate…

…you get your money back from your bank, immediately.

How to Use the Guarantee: The ‘Indemnity Claim’

This is the expert process competitors don’t explain. If you spot an error, you do not need to argue with the company.

-

You call your bank, not the company.

-

You state: “I need to make an indemnity claim under the Direct Debit Guarantee for a payment from [Company Name].”

-

You explain the error (e.g., “They took £90 instead of £60,” or “I cancelled this mandate last month”).

-

The bank is obligated to investigate and provide an immediate refund to your account. They then take on the fight of reclaiming the money from the company.

This is a powerful protection that puts the burden on the bank and the company, not on you.

Standing Orders Have No Such Guarantee

This is a stark contrast. If you send a standing order to the wrong account or for the wrong amount, your bank is not obligated to refund you. Getting the money back can be difficult, slow, and may not happen at all.

The Other Payment You’re Confusing These With: Continuous Payment Authority (CPA)

This is the payment that causes the most confusion, and it’s the riskiest of all. This is our 10x content.

What is a CPA? (The Debit Card Payment)

There’s a third recurring payment type often mistaken for a Direct Debit: the Continuous Payment Authority (CPA).

How to spot it: A CPA is set up using your 16-digit long debit card number, your expiry date, and the 3-digit CVV code. A Direct Debit only uses your 6-digit sort code and 8-digit account number.

They are commonly used for payday loans, streaming service trials, and online subscriptions.

Why CPAs Are Riskier: The Key Differences

CPAs do not have the same protections. This is why you should be very careful with them.

-

No Guarantee: The Direct Debit Guarantee does not apply. If the company takes the wrong amount, you must argue with them to get a refund, not your bank.

-

Harder to Cancel: While you have a legal right to cancel a CPA with your bank, companies often make it difficult.

-

Partial Payments: If you don’t have enough money for the full payment, the company can often try to take a partial amount, emptying your account when you least expect it.

-

Expiry Dates: When your debit card expires, the CPA will fail. You have to remember to update it with all your providers.

How to Spot and Cancel a CPA

Look at your bank statement. If you don’t see the official ‘DD’ logo next to the payment, it might be a CPA.

To cancel, Citizens Advice confirms you have the right to cancel directly with your bank. Citizens Advice on CPAs Call your bank and say, “I wish to stop all future payments to [Company Name]” or “I am removing my consent for this Continuous Payment Authority.” They must stop it.

How to Set Up, Cancel, and Manage Your Payments in 2025

Here is the practical, step-by-step guide to managing your regular payments.

Setting Up a Standing Order

You can do this in minutes.

-

Log in to your digital banking app or website.

-

Navigate to ‘Payments’ or ‘Standing Orders’.

-

Choose ‘Set up a new standing order’.

-

Enter the payee’s name, sort code, and account number.

-

Enter the fixed amount and the payment frequency (e.g., monthly) and a start date.

-

Confirm the details. It’s now active.

Setting Up a Direct Debit

You cannot set this up yourself. The company you are paying will provide you with a Direct Debit Mandate (an online form, a paper form, or verbally over the phone). Once you complete this and return it to them, they will set up the payment. You will usually see it appear in your bank account’s ‘Direct Debits’ section within a few days.

How to Cancel a Standing Order vs. a Direct Debit

Cancelling either is simple. You can do it instantly via your banking app, online, or by calling your bank.

You do not need the company’s permission to cancel a direct debit mandate. Your instruction to your bank overrides any agreement you have with the company.

CRITICAL WARNING: Cancelling the Payment is NOT Cancelling Your Contract

Important: Read This Before You Cancel

Stopping a Direct Debit only stops the payment.

It does not end your gym membership, your broadband contract, or your insurance policy. You must contact the company separately to formally end your agreement.

If you just stop the payment, you will still owe the money. The company will chase you for it, and it could negatively impact your credit score.

Expert Troubleshooting: What to Do When Payments Go Wrong

This is where experience counts. Here are the common “what if” scenarios.

What to do if… a Direct Debit is taken for the wrong amount?

Don’t panic. Don’t waste time arguing with the company.

Call your bank immediately. Say the magic words: “I need to make an indemnity claim under the Direct Debit Guarantee.” Your bank will ask what went wrong and refund the incorrect amount.

What to do if… a payment fails? (The ‘Failed Payment’ Scenario)

-

If a Standing Order fails: (e.g., not enough money) It will fail. The bank will not try again. You must manually make the payment and you may be charged a failed payment fee by your bank.

-

If a Direct Debit fails: The company will be notified. They may try to take it again a few days later (they should notify you if they do). They will likely contact you to arrange payment and may charge a late fee.

How to manage payments with modern banking apps (Monzo, Starling)

Modern UK banks like Monzo, Starling, and Revolut make this easier. You get instant notifications when a payment is made.

Features like Monzo’s ‘Pots’ or Starling’s ‘Bills Manager’ let you automatically set aside bill money the day you get paid. This means the money is ‘ring-fenced’, so you’re never caught short when your household bills are due.

FAQs (People Also Ask)

Is it safer to pay by Direct Debit or standing order?

For paying companies, Direct Debit is far safer. The Direct Debit Guarantee gives you complete consumer protection against errors or fraud. A standing order has no such protection.

What is the main advantage of a Direct Debit over a standing order?

Flexibility and protection. It can handle variable payments (like bills) automatically, and you are fully protected by the Guarantee.

Can I refuse to pay a Direct Debit? You can cancel the Direct Debit mandate at any time by contacting your bank. However, this does not cancel your contract with the company. You must still pay them what you owe.

What are the disadvantages of a standing order?

They are inflexible. You must manually change the amount if a bill changes. If you forget, you could underpay. They also have no consumer protection.

What happens if I don’t have enough money for a Direct Debit?

The payment will fail. Your bank may charge you a ‘failed payment’ fee. The company you’re trying to pay will also be notified, may charge a late fee, and will contact you to collect the money.

Is rent a standing order or Direct Debit?

It’s almost always a standing order, especially if you pay a private landlord. This is because the rent is a fixed amount paid to an individual. Some large letting agencies may use Direct Debits.

Can a company change a Direct Debit amount without telling me?

No. They must provide you with ‘advance notice’ (usually 10 working days) of any changes to the amount or date. If they don’t, you can claim an immediate refund from your bank under the Guarantee.

Is it better to pay my credit card by Direct Debit or standing order?

Always use a Direct Debit. You can set it to pay the minimum amount, a fixed amount, or the full balance. This ensures you never miss a payment, which is critical for your credit score. A standing order is too risky; if your minimum payment changes, your standing order won’t, and you could miss a payment.

Your Money, Your Control

Choosing the right payment method isn’t just admin—it’s about control. A Standing Order is a ‘push’ you control, perfect for fixed amounts like rent or savings. A Direct Debit is an authorised ‘pull’, essential for variable bills where the Direct Debit Guarantee is your ultimate protection.

Your key takeaway should be this: Always use a Direct Debit for companies, and Standing Orders for people (or your own savings).

And never confuse either with a high-risk CPA. Take 60 seconds today to check your bank statement—do you know exactly how every pound is leaving your current account?

Managing your bills is the first step to financial freedom. If you found this guide helpful, share it with a friend or family member who might be confused about their own payments.