How Much Can I Borrow for a Mortgage? The Definitive 2025 UK Guide

You’ve found the perfect home, but the big question looms: ‘How much can I actually borrow?’ Using a simple online calculator is one thing, but what do lenders really think? Answering the question “how much can i borrow mortgage” is the most critical first step in your home-buying journey, and in 2025, the answer is more complex, and potentially more flexible, than ever before.

The final amount you’re offered isn’t just a simple “4.5x salary” rule. It’s a detailed financial assessment. Following a major review by the Financial Conduct Authority (FCA) in 2025, lenders are now operating under new Consumer Duty rules, balancing strict affordability checks with a new push for flexibility.

This definitive guide will demystify the entire process. We’ll go beyond the simple ‘income multiple’ and show you exactly how lenders conduct their affordability checks, what factors you control, and provide a step-by-step plan to maximise your borrowing power. This is the guide to read before you apply.

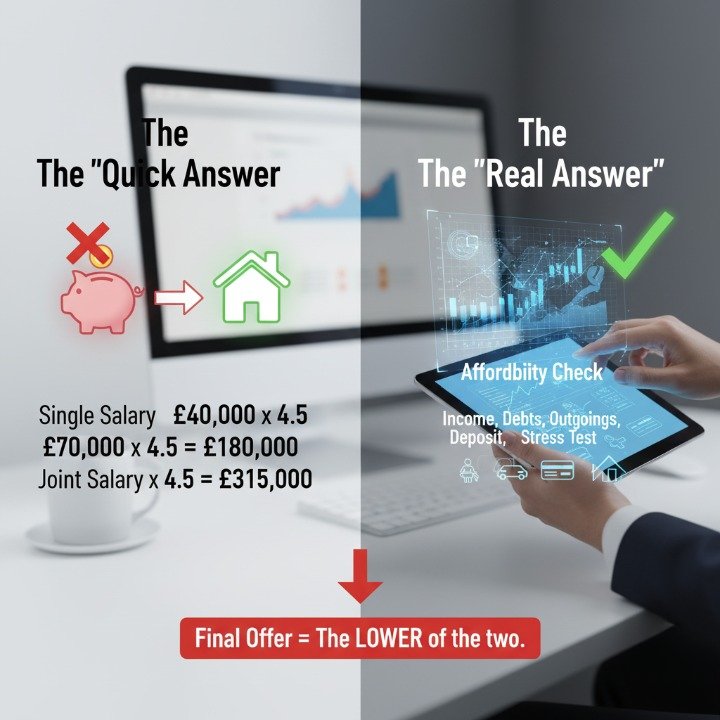

The “Quick Answer” vs. The “Real Answer”

When you first ask this question, you’ll get two very different answers.

The “Quick Answer”: The Income Multiple Rule

This is the “rule of thumb” you’ll hear from friends and family. A lender will offer a baseline amount based on a simple income multiple, typically 4.0 to 4.5 times your gross (pre-tax) annual income.

-

Single Applicant: £40,000 salary x 4.5 = £180,000

-

Joint Applicants: £70,000 combined salary x 4.5 = £315,000

This is a Loan-to-Income (LTI) ratio. The Bank of England sets a rule that lenders must limit the number of mortgages they offer at 4.5x LTI or higher. This is why 4.5x has become the industry standard.

Why the “Quick Answer” is Usually Wrong

This simple calculation is just a starting point. It fails to account for the single most important part of your application: your affordability.

The final number you are offered will be the lower of these two calculations:

-

Your Income Multiple (the “quick answer”)

-

Your Affordability Check (the “real answer”)

If you have high debts or childcare costs, the “real answer” will almost certainly be lower than the “quick answer.”

Can I Get a 5 or 6 Times Salary Mortgage?

Yes, this is possible in 2025, but it is not the norm. Lenders have some flexibility to offer higher LTI mortgages (like 5, 5.5, or even 6 times) to a small percentage of applicants.

These are typically reserved for:

-

High Earners: Applicants with a high gross annual income (e.g., over £75,000).

-

Certain Professions: Roles with clear, rising pay scales like doctors or lawyers.

-

Low-Risk Applicants: Those with a very large deposit (e.g., 25%+) and no other debts.

While a July 2025 review by the Prudential Regulation Authority (PRA) is giving lenders more flexibility, don’t bank on this. The “real answer” is what truly matters.

The “Real Answer”: The 2025 Mortgage Affordability Check Explained

This is the “real” test. An affordability check is a detailed financial audit, required by the Financial Conduct Authority (FCA), to prove you can afford the monthly payments. It’s not just about your ability to pay today, but your ability to pay if your circumstances changed.

The Lender’s “Stress Test”

This is the ‘why’ behind the check. Lenders don’t just calculate affordability at today’s interest rate. They must “stress test” your finances to prove you could still make the payment if the interest rate rose significantly, typically by 2-3% above their current standard variable rate.

This is the #1 reason people can borrow less than they expect. Your debts (like a car loan) are factored into this “stressed” monthly payment, quickly reducing your borrowing power.

The Impact of the 2025 FCA Review

The landscape is changing. The FCA’s new Consumer Duty rules, which are fully embedded in 2025, require lenders to act in your best interests and “avoid foreseeable harm.”

This has had two effects:

-

Strict Checks: Lenders are still laser-focused on your outgoings.

-

New Flexibility: Lenders are being actively encouraged to be more flexible. A 2025 FCA discussion paper (DP25/2) is exploring new, innovative ways to assess affordability. This includes proposals to allow lenders to formally consider your history of rental payments as proof you can afford a similar-sized mortgage.

This is great news for first-time home buyers who have a strong record of paying rent but might not pass the traditional test.

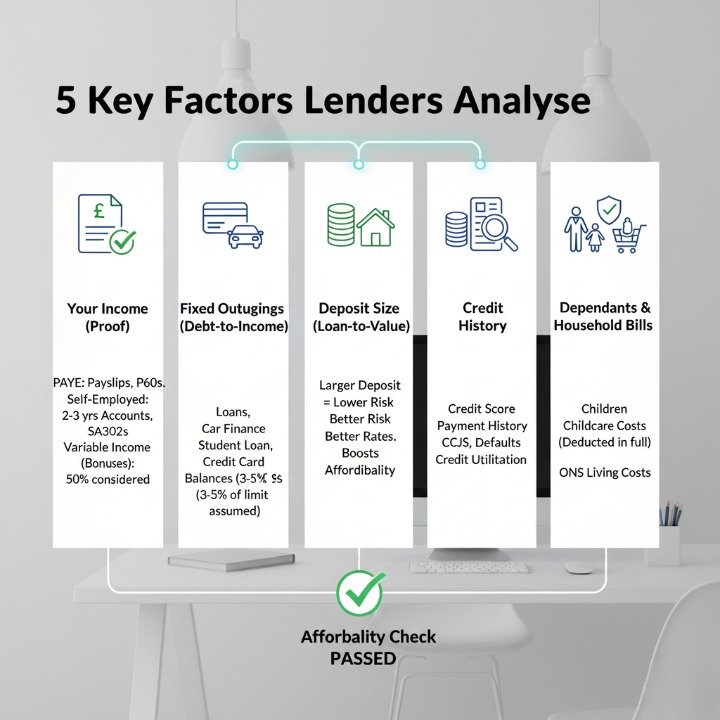

De-Mystified: The 5 Key Factors Lenders Analyse

A lender is trying to build a complete picture of your financial health. They will analyse these five areas in detail.

Factor 1: Your Income (The “Proof”)

This is what you can prove, not just what you earn.

-

Employed (PAYE): Lenders will use your gross basic salary. For bonuses, commission, or overtime, they will be more cautious. They typically ask for 2-3 years of P60s and may only consider 50% of this “variable” income.

-

Self-Employed: This is a common pain point. Lenders need to see consistency. For a self-employed mortgage, be prepared to provide:

-

2-3 years of finalised accounts.

-

Your SA302s (Tax Calculations) and Tax Year Overviews from HMRC.

-

-

Company Director: Lenders will assess your income in different ways. Some look at your salary and dividends only. Others will look at your salary plus your share of the net profit after tax. A good mortgage broker is essential here, as they know which lenders are most favourable for company directors.

Factor 2: Your Fixed Outgoings (Debt-to-Income Ratio)

This is where most applications are won or lost. Lenders are not really concerned with your £10 Netflix subscription. They are looking for fixed credit commitments.

Your Debt-to-Income (DTI) ratio is the percentage of your monthly income that goes on debts.

Lenders will analyse your last 3-6 months of bank statements for:

-

Personal Loans

-

Car Finance (a major factor)

-

Student Loan (they now calculate this as a fixed percentage of your income)

-

Child Maintenance Payments

-

Hire Purchase agreements

-

Credit Card Balances: This is a big one. Even if you pay it off each month, some lenders will “assume” a fixed monthly payment of 3-5% of your total limit. A £10,000 limit could be seen as a £500/month outgoing, even if you owe nothing.

Factor 3: Your Deposit Size (Loan-to-Value or LTV)

Your deposit directly impacts your Loan-to-Value (LTV) ratio—the percentage of the property’s value you are borrowing.

A larger deposit (and lower LTV) makes you a much lower risk. This not only unlocks better interest rates but can also boost your affordability. Why? Because a lower rate means a lower monthly payment, which is easier to pass the “stress test” on.

Factor 4: Your Credit History

This is not just your credit score. The score itself is just a number. Lenders pull your full credit history from agencies like Experian, Equifax, or TransUnion.

They are looking for red flags:

-

Missed or late payments

-

Defaults or CCJs (County Court Judgements)

-

High credit utilisation (using more than 50% of your available credit)

-

Recent applications for new credit

-

Payday loans (a significant red flag for most lenders)

Factor 5: Your Dependants & Household Bills

Lenders will ask how many financial dependants you have (e.g., children). This is a major factor.

-

Childcare Costs: This is treated like a large loan. Lenders will deduct your monthly childcare costs in full from your income before calculating what’s left for a mortgage.

-

Household Spending: Lenders also use background data from the Office for National Statistics (ONS) to estimate your baseline spending on essentials (food, utilities, transport) based on your family size. This is a non-negotiable deduction.

How This Works in Practice: A 2025 Case Study

Let’s put this all together. According to the ONS, the median salary for a full-time employee in their 30s is around £42,000. Let’s create two realistic profiles.

Meet Alex: The First-Time Buyer

-

Profile: £42,000 salary

-

Deposit: £30,000

-

Debts: £250/month car loan, Plan 2 student loan

-

Lender’s View:

-

The “Quick Answer”: £42,000 x 4.5 = £189,000. Alex thinks he can borrow this much.

-

The “Real Answer” (Affordability Check): The lender’s stress test adds the £250 car payment and the student loan deduction to the “stressed” mortgage payment. This combination means Alex’s “disposable” income is much lower. The lender’s system calculates he can only safely afford payments on a £165,000 mortgage.

-

-

Result: Alex is offered £165,000, which is £24,000 less than he expected.

Meet Priya & Ben: The Home Movers

-

Profile: £85,000 combined salary (£42k + £43k)

-

Deposit: £80,000 equity from their sale

-

Debts: 2 children with £1,000/month in nursery fees

-

Lender’s View:

-

The “Quick Answer”: £85,000 x 4.5 = £382,500.

-

The “Real Answer” (Affordability Check): The lender sees the £1,000/month childcare as a £12,000 annual fixed “debt.” This massively reduces their affordability. The lender’s stress test concludes they can only afford a £310,000 mortgage.

-

-

Result: Priya & Ben are offered £72,500 less than they thought.

SME Pro-Tip: Lenders assess childcare costs as a non-discretionary, major expense. If your children are ending nursery in the next 6-12 months (e.g., starting primary school), prove this to the lender. Providing a letter from the school or nursery confirming the end date can dramatically increase your borrowing power.

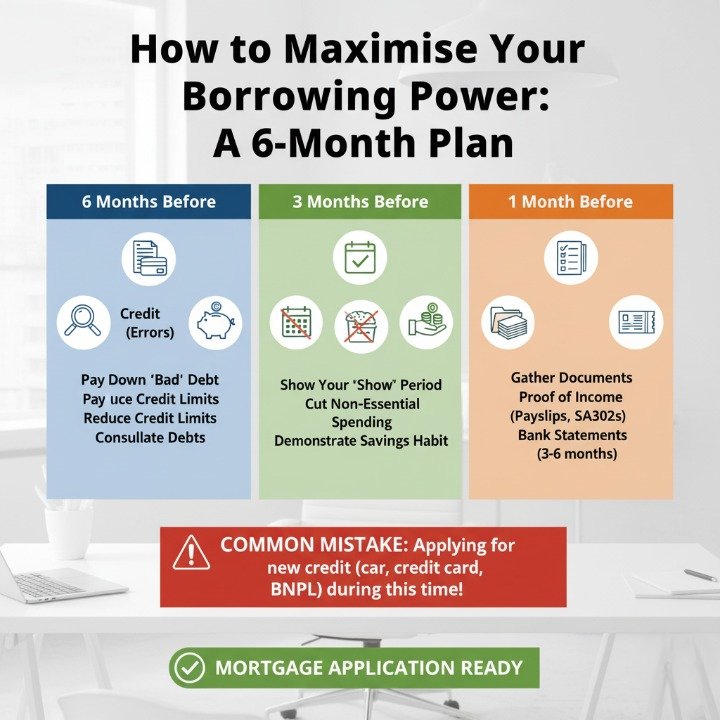

How to Maximise Your Borrowing Power: A 6-Month Plan

You have more control than you think. If you’re planning to apply for a mortgage, start preparing 6 months out.

6 Months Before: The “Debt Cleanse”

-

Get Your Credit Reports: Download all three (Experian, Equifax, TransUnion). Check them for any errors and get them corrected.

-

Pay Down “Bad” Debt: Focus on high-interest debt first. Clear any store cards or payday loans (which are a major red flag).

-

Reduce Credit Limits: If you have a £10,000 credit card limit you never use, consider reducing it to £2,000. This lowers your “assumed” debt in the affordability check.

-

Consolidate: If you have multiple small, high-interest debts, a single debt-consolidation loan (with a lower rate) can improve your DTI ratio.

3 Months Before: The “Spending Freeze”

-

This is Your “Show” Period: Lenders will ask for your last 3 months of bank statements. Make them pristine.

-

Reduce Non-Essential Spending: Cut back on takeaways, online gambling, and large cash withdrawals.

-

Show a “Savings Habit”: Actively move a set amount of money into a savings account on payday. This demonstrates you can live within your means and are financially responsible.

Common Mistake: Applying for new credit (a car loan, a new credit card, or even a ‘buy now, pay later’ sofa) in the 6 months before your mortgage application. This creates a “hard check” on your file and adds a new monthly outgoing, both of which can significantly reduce your final offer. Wait until after you have the keys.

1 Month Before: Get Your Documents Ready

Having this folder ready will make the process smooth and show you are a serious applicant.

-

Photo ID: Passport or driving licence

-

Proof of Address: Recent utility bill or council tax statement

-

Proof of Income (Employed): Your last 3 months’ payslips and your latest P60. (Have 6 months of payslips ready if you rely on commission or overtime).

-

Proof of Income (Self-Employed): Your last 2-3 years’ SA302s and Tax Year Overviews.

-

Proof of Deposit: Bank statements for the account your deposit is in (and evidence of where it came from, e.g., “Gifted Deposit Letter”).

-

Bank Statements: Your last 3-6 months of statements for all current accounts.

What is an Agreement in Principle (AIP)?

An Agreement in Principle (AIP), also called a Mortgage in Principle (MIP) or Decision in Principle (DIP), is the real first step.

This is a conditional offer from a lender that states in principle how much they are willing to lend you. It is based on a quick check of your income, debts, and a “soft” credit check.

Soft vs. Hard Credit Check

Most AIPs use a soft credit check, which is not visible to other lenders and does not affect your credit score. This allows you to shop around.

A hard credit check only happens when you submit a full mortgage application. This is visible to other lenders. Having too many hard checks in a short period can lower your score.

Getting an AIP is essential. It shows estate agents you are a serious buyer and gives you a realistic budget to work with.

Conclusion: Think Like a Lender, Not a Calculator

Finding out ‘how much you can borrow’ isn’t one number. It’s a balance between your income multiple (the 4.5x baseline) and the result of the lender’s deep-dive affordability check (your debts, outgoings, and deposit). Your final offer will be the lower of these two figures.

The mistake many buyers make is focusing on the ‘maximum’ they can borrow. The smartest buyers focus on proving their affordability. By preparing your finances 3-6 months in advance, you aren’t just asking for a loan; you’re demonstrating you’re a safe and reliable investment. That’s how you get the best deal.

Ready to see where you truly stand? Talk to an independent mortgage broker. They have access to hundreds of lender-specific affordability rules (which vary dramatically) and can guide you to the one that best fits your financial situation.

FAQs

How much mortgage can I get on a 50k salary UK?

As a rough guide, using the 4.5x income multiple, you could borrow around £225,000. However, this will be heavily reduced by the affordability check if you have debts, a student loan, or high childcare costs.

How much can I borrow on a 30k salary UK?

Using the 4.5x income multiple, the baseline would be £135,000. This is a common salary for first-time buyers, so lenders will pay very close attention to your bank statements and outgoings to ensure you can pass the stress test.

How do banks decide how much to lend you for a mortgage?

Banks use a two-part test:

-

Income Multiple: A simple calculation (usually 4.0-4.5x your gross income).

-

Affordability Check: A detailed audit of your income, fixed debts (loans, credit cards), and outgoings (dependants, childcare) to see if you can afford the payments, even if interest rates rise. Your final offer is the lower of these two results.

What salary do I need to get a 200k mortgage?

To get a £200,000 mortgage, you would need a gross annual income of approximately £44,500 (as £44,500 x 4.5 = £200,250). This assumes you have no other debts and can pass the lender’s affordability checks.

What is the 5 times salary mortgage rule?

This is a mortgage offered at a Loan-to-Income (LTI) ratio of 5. It is not a standard “rule.” It is a higher-risk product that some lenders reserve for applicants with high salaries (e.g., £75k+), large deposits, and low levels of debt.

Can I get a mortgage 6 times my salary?

It is extremely rare to get a 6x salary mortgage in 2025. This is only offered by a few specialist lenders, often for specific professions (like doctors or lawyers) who have a very clear and high-earning career path. You must have a perfect credit history and a large deposit.

Does student loan affect mortgage borrowing?

Yes, significantly. Lenders view your student loan as a fixed outgoing. They will factor in your monthly repayments (or a percentage of your income) as part of the affordability check, which will reduce the total amount you can borrow.

Do banks check your spending for a mortgage?

Yes. They will ask for your last 3-6 months of bank statements. They are not looking to penalise you for buying coffee. They are looking for:

-

Fixed Debts: Undisclosed loans or credit card payments.

-

Red Flags: Large cash withdrawals, online gambling transactions, or regularly going into your overdraft.

-

Affordability: Proof that your stated income and outgoings match reality.