Universal Credit Increase 2026: New Rates, £725 Boost, and Major Policy Shifts Explained

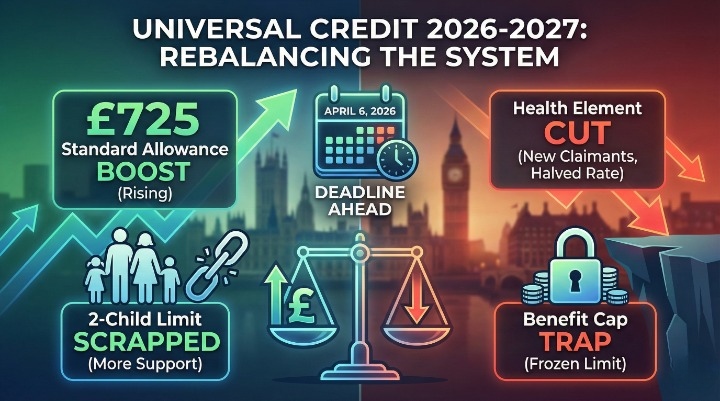

April 6, 2026, marks the single biggest structural shift to the welfare system in a decade. If you are one of the six million households relying on DWP support, the headlines might look promising: a headline inflation figure of 3.8% and a “legislated uplift” boosting the standard allowance. But the Universal Credit benefits increase 2026 2027 is not a simple pay rise. It is a rebalance.

While millions will see their bank payments jump by up to £725 a year, a specific group of new claimants faces a harsh financial cliff edge. The scrapping of the two-child limit brings hope for large families, yet the controversial “halving” of the LCWRA element for new applicants creates a frantic deadline for thousands.

This guide cuts through the noise. We will break down the confirmed 2026/27 payment tables, explain who the “winners and losers” are, and provide the exact steps you must take before February to protect your household income.

Universal Credit Rates 2026/27: The Official Monthly Breakdown

The Department for Work and Pensions (DWP) has confirmed the new rates for the 2026/27 tax year. Unlike previous years where rates simply tracked the Consumer Price Index (CPI), this year includes the additional 2.3% “rebalancing uplift” outlined in the Universal Credit Act 2025.

This means the Standard Allowance is rising by approximately 6.2% overall.

Standard Allowance Increases (6.2% Uplift)

This is the basic amount you receive before any additional elements (like housing or children) are added.

| Claimant Status | 2025/26 Monthly Rate | 2026/27 Monthly Rate (New) | Annual Increase |

| Single (Under 25) | £316.98 | £338.58 | +£259.20 |

| Single (25 or Over) | £400.14 | £424.90 | +£297.12 |

| Joint Claimants (Both under 25) | £497.55 | £528.34 | +£369.48 |

| Joint Claimants (One/Both 25+) | £628.10 | £666.97 | +£466.44 |

Claimant Pro-Tip:

These figures are your base rate. If you have earnings from work, the “Work Allowance” is also increasing to £416 (for those with housing costs) and £688 (for those without). This means you can earn more before your Universal Credit begins to taper off.

Child Element & The Scrapping of the 2-Child Limit

Perhaps the most significant change for families is the removal of the two-child limit policy. Since 2017, families could only claim extra support for their first two children.

From April 6, 2026, you can claim the “Child Element” for all eligible children, regardless of when they were born.

-

First Child (born before 6 April 2017): Rising to £348.15

-

Child (born on/after 6 April 2017 or subsequent children): Rising to £293.45

If you have a third or fourth child, this change could be worth over £3,500 per year per additional child.

The “Health Element” Rebalance: Why New LCWRA Rates are Halving

This is the section of the Universal Credit benefits increase 2026 2027 that most news outlets are burying. To fund the increase in the Standard Allowance, the government has restructured the health element.

Currently, the “Limited Capability for Work and Work-Related Activity” (LCWRA) element is worth £416.19. In April, this creates a split system.

New Claimants vs. The Protected Cohort

-

Existing Claimants (Protected): If you are already receiving LCWRA before April 6, 2026, your rate will rise with inflation to £432.27. You are safe.

-

New Claimants: If you apply after the deadline, you will be placed on the new “Health Support Tier,” which is set at £217.26.

This is a massive £215 monthly loss compared to the old system.

The Deadline Trap: Why You Must Act Before February 2026

This is critical. Universal Credit has a three-month “assessment period” (waiting period) for health elements.

To be considered an “Existing Claimant” and lock in the higher £432.27 rate, you must have submitted your first “Fit Note” and triggered the Work Capability Assessment (WCA) process before January 31, 2026.

Experience from the Journal:

I have seen claimants lose thousands because they waited “until they felt worse” to upload a fit note. Go to your online journal today. Under “Report a Change of Circumstances,” select “Health.” Upload your fit note immediately. Even if your assessment happens in May, the date you reported the change locks you into the 2025 rules.

Additional Benefit Increases for 2026/27

Universal Credit isn’t the only support seeing a shift. The Department for Work and Pensions (DWP) benefit rates 2026-27 update covers legacy benefits and disability payments too.

Disability Benefits (PIP, DLA, Attendance Allowance)

Unlike the “rebalanced” Universal Credit, disability benefits are rising strictly in line with the September 2025 CPI figure of 3.8%.

-

PIP Daily Living (Enhanced): Rising to £112.75 per week.

-

PIP Mobility (Enhanced): Rising to £78.65 per week.

[See the full breakdown of PIP rates on GOV.UK]

State Pension Triple Lock (4.8% Increase)

The State Pension Triple Lock has once again outpaced working-age benefits. Due to strong wage growth figures, the Basic and New State Pension will rise by 4.8%.

While this is good news for pensioners, mixed-age couples (where one partner is pension age and the other is not) claiming Universal Credit need to be careful. The rise in State Pension income counts as “unearned income” and will be deducted from your Universal Credit pound-for-pound.

The Benefit Cap Trap: Will You Actually See the Extra Cash?

Here is the sting in the tail. While the Universal Credit benefits increase 2026 2027 looks generous on paper, the Benefit Cap has been frozen for another year at £22,020 (Greater London) and £19,320 (Rest of UK) for families.

This creates a dangerous “Cap Trap.”

Scenario: You are a single mum renting privately in Manchester with three children.

-

The Good News: The 2-child limit scrap means you are now eligible for an extra £293.45 a month for your third child.

-

The Bad News: This extra money pushes your total benefits over the £1,610 monthly cap limit.

-

The Result: The DWP deducts the excess from your payment. You receive £0.00 of the increase.

How to avoid this:

If you can work enough hours to earn the equivalent of 16 hours at National Minimum Wage, you become exempt from the Benefit Cap. For many, finding part-time work will be the only way to actually unlock the 2026 increases.

FAQs

How much will Universal Credit go up in April 2026?

The Standard Allowance is increasing by roughly 6.2%. For a single person over 25, this means a rise from £400.14 to £424.90 per month.

When is the 2-child benefit cap being removed?

The limit is officially removed for assessment periods starting on or after April 6, 2026. If your assessment period starts on April 1st, you won’t see the change until your May payment.

What are the new LCWRA rates for 2026?

It depends on when you claim. Existing claimants will receive £432.27. New claimants applying after April will receive the lower rate of £217.26.

Will PIP increase in 2026?

Yes. PIP and other non-means-tested disability benefits will rise by 3.8%. This increase does not affect your Benefit Cap limit.

Is the benefit cap increasing in 2026?

No. The Benefit Cap remains frozen. This will likely drag an estimated 40,000 more families into the cap due to the underlying rate increases.

Can I get the old LCWRA rate if I apply now?

Yes, but you must be quick. You need to report your health condition and provide a fit note before the end of January 2026 to ensure your “waiting period” starts under the current rules.

Will my Universal Credit be reduced if I get the state pension increase?

Yes. State Pension is treated as income. If your pension goes up by £40 a month, your Universal Credit will effectively go down by £40 a month, leaving you with no net gain on that portion.

Summary: Winners and Losers

The Universal Credit benefits increase 2026 2027 is a complex mix of generosity and cuts.

-

Winners: Single claimants and large families who are exempt from the Benefit Cap.

-

Losers: New health claimants who miss the January deadline and families hitting the frozen Benefit Cap.

-

Urgent Action: If you have a health condition preventing you from working, log into your journal today. Do not wait for April.

The landscape of UK welfare is shifting. As Managed Migration concludes on March 31, 2026, the safety net is changing shape. Ensure you are on the right side of the cut-off.

[Bookmark 2026 Benefit Calculator to see your exact payment date]