UK Side Hustle Tax Guide 2025: Trading Allowance & The New 2026 HMRC Rules

The countdown to January 31, 2026, has officially begun. For millions of people across Britain, this month marks a significant shift in how secondary income is tracked and taxed. If you spent the last year selling vintage finds on Vinted, driving for Deliveroo, or hosting on Airbnb, you might be feeling a sense of dread about the so-called “Side Hustle Tax.”

There is a lot of misinformation circulating on social media regarding what HMRC knows and who needs to pay. The reality is that the side hustle tax uk 2025 rules are not actually a “new tax.” Instead, they are a new way for the government to ensure everyone plays by the existing rules. Since January 2024, digital platforms have been required to collect data on seller income, and as of this month, that data is being shared directly with tax authorities.

This guide clears the fog. We will break down the £1,000 trading allowance, explain exactly what the new 2026 reporting rules mean for you, and help you determine if you are a “hobbyist” or a professional trader. By the end of this article, you will know exactly where you stand with HMRC and how to avoid the £100 automatic late filing penalty.

The £1,000 Trading Allowance: How Much Can You Really Earn?

The “Trading Allowance” is your most important tool as a side-hustler. Introduced to simplify tax for small earners, it allows you to earn up to £1,000 in gross income from a side business without paying a penny in tax or even telling HMRC about it.

Understanding Gross Income vs. Profit

A common mistake many beginners make is thinking the £1,000 limit applies to their profit. It does not. The trading allowance 2025 rules state that the limit applies to your gross income.

Gross income is the total amount of money you receive before you take away any expenses. For example, if you sell an item on eBay for £100, but the platform takes £10 in fees and postage costs you £5, your profit is £85. However, for the purposes of the allowance, HMRC looks at the full £100.

My Pro-Tip: The “Fee Trap”

Always calculate your income based on what the customer paid, not what landed in your bank account. If you earn £1,050 but platform fees bring you down to £900, you have technically exceeded the allowance and must register for Self Assessment.

Does the £1,000 Apply Per Side Hustle?

No. This is a “total combined” allowance. If you earn £600 from dog walking and £500 from selling handmade candles, your total income is £1,100. Because this exceeds £1,000, you must report all of it to HMRC. You cannot claim a separate £1,000 allowance for every different activity you do.

Digital Platform Reporting: What HMRC Knows in 2026

If you use apps like Vinted, Etsy, eBay, or Depop, the rules changed behind the scenes over the last two years. Under the OECD’s “Model Reporting Rules,” these platforms must now report seller data to HMRC if certain triggers are met.

The Vinted, eBay, and Etsy “Data Dump” Explained

As of January 2026, these platforms have officially started transmitting full data sets for the 2025 calendar year. GOV.UK guidance on digital platform reporting. HMRC’s sophisticated “Connect” computer system can now automatically cross-reference this platform data with your existing tax records.

If the data shows you received more than £1,000 in a tax year and you haven’t declared it, you are likely to receive an “HMRC Nudge Letter” asking you to clarify your position.

The 30 Sales / €2,000 Threshold Myth

You may have heard that HMRC only cares if you make more than 30 sales or earn over €2,000 (roughly £1,700). This is a reporting threshold for the platforms, not a tax threshold for you.

The platforms only have to send your data automatically if you hit those numbers. However, the self assessment side hustle threshold remains £1,000. If you earn £1,200 across 10 sales, the platform might not report you automatically, but you are still legally required to declare that income yourself.

Are You a Hobbyist or a Trader? (The HMRC “Badges of Trade”)

One of the biggest areas of confusion is the difference between selling your old “clutter” and running a business. HMRC uses a concept called the “Badges of Trade” to decide.

Selling Your Old Clothes vs. Buying to Resell

If you are clearing out your wardrobe or loft, you are generally not “trading.” Even if you sell £2,000 worth of old baby clothes on Vinted, you usually won’t owe tax because you are selling items for less than you originally paid for them. This is considered a “disposal of personal possessions.”

However, if you go to a charity shop, buy five designer bags, and list them on eBay specifically to make a profit, you are trading. In this scenario, the £1,000 allowance applies immediately.

| Activity | Tax Category | Reporting Needed? |

| Selling your own old sofa | Hobby / Disposal | No |

| Buying furniture to “upcycle” and sell | Trading | If over £1,000 gross |

| Selling handmade crafts on Etsy | Trading | If over £1,000 gross |

| Renting out a spare room | Property Income | Covered by ‘Rent a Room’ Relief |

The “Intent to Profit” Test

HMRC looks at your intent. Did you buy the item to use it, or to sell it? Do you sell items regularly? Do you have a “shop” name or branding? If the answer is yes, you are likely a trader in the eyes of the law.

Content Gap: The £3,000 Reporting Threshold Confusion

There has been significant chatter on social media about the tax-free limit rising to £3,000. It is vital to clarify this to avoid heavy fines.

Is the tax-free limit rising to £3,000?

Currently, no. The £1,000 trading allowance remains the law for the 2025/26 tax year. The £3,000 figure comes from a government proposal aimed at reducing the number of people who have to file a full Self Assessment return for very small amounts of tax.

While this may become part of the side hustle tax uk 2025 landscape in future updates, you must continue to use the £1,000 threshold for your current filings. Following social media advice over official HMRC guidance is a quick way to land a “failure to notify” penalty.

How to Register as a Sole Trader in the UK

If you realized you have crossed the £1,000 line, don’t panic. Registering is a straightforward process that legitimises your business.

Getting Your UTR Number (Step-by-Step)

To register as sole trader UK, you need to sign up for Self Assessment through the GOV.UK website.

-

Set up a Government Gateway ID: You will need your National Insurance number and basic ID.

-

Register for Self Assessment: Tell HMRC you are “working for yourself.”

-

Wait for your UTR: HMRC will post your Unique Taxpayer Reference (UTR) number. This usually takes 10 working days.

-

Activate your account: Use the code sent in the post to finish the setup.

Key Deadlines: October 5th and January 31st

The UK tax year runs from April 6 to April 5.

-

October 5: The deadline to tell HMRC you started a side hustle in the previous tax year.

-

January 31: The deadline to file your return online and pay any tax you owe.

If you miss the January 31 deadline by even one minute, HMRC issues an automatic £100 fine. Even if you owe £0 in tax, the fine for late filing still applies.

Side Hustle Tax Calculator: Estimating Your Bill

How much will you actually pay? This depends on your total income, including your main job.

Factoring in Your Main Job (PAYE)

Your side hustle income is added to your salary. If you earn £30,000 at your 9-to-5 job, you have already used your Personal Allowance (£12,570). This means every pound of profit from your side hustle (after the first £1,000) will be taxed at the basic rate of 20%. If you are a high earner (£50,271+), your side hustle profit will be taxed at 40%.

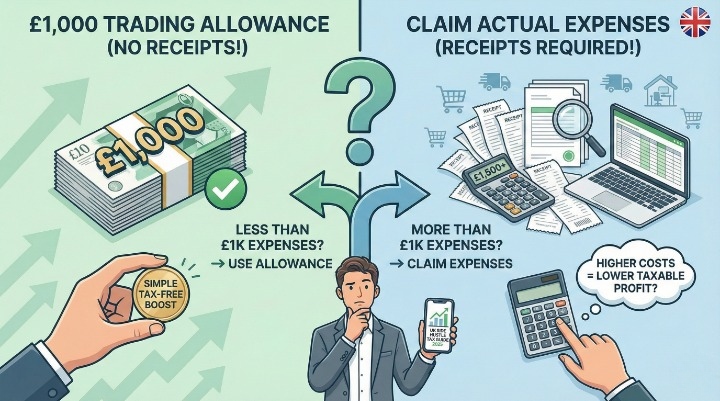

Claiming Expenses vs. The Trading Allowance

You have a choice. You can either:

-

Take the £1,000 trading allowance 2025 (no receipts needed).

-

Claim actual “allowable expenses” (receipts required).

If your expenses (postage, materials, software, mileage) are less than £1,000, always take the allowance. If your expenses are higher (e.g., you spent £1,500 to make £2,000), claim the actual expenses instead. You cannot do both.

FAQs

Do I pay tax on Vinted sales if I’m just clearing out my wardrobe?

Generally, no. If you are selling personal items for less than you bought them for, it is not taxable income.

Can I use the trading allowance if I am also employed?

Yes. The allowance is specifically designed for people with secondary incomes.

What happens if I missed the January 31st deadline?

File as soon as possible. The longer you wait, the higher the penalties. HMRC is often more lenient if you come to them before they “nudge” you.

Do I need to pay National Insurance on a side hustle?

Only if your profits exceed certain thresholds (currently £12,570 for Class 4 NI). Most small side hustles won’t trigger this.

Is the ‘Side Hustle Tax’ a new law?

No. The tax laws haven’t changed; only the way HMRC receives data from apps has changed.

What is an HMRC “Nudge Letter” and should I be scared?

A nudge letter is a “polite” reminder from HMRC saying they think you might have undeclared income. It isn’t an accusation of fraud, but you must respond to it to avoid a formal investigation.

Final Thoughts: The Importance of “Record Hygiene”

The most important takeaway for any side-hustler in 2025 is to stay organized. HMRC does not expect you to be a chartered accountant, but they do expect you to keep “adequate records.”

Expert Insight:

Spend 10 minutes at the end of every month updating a simple spreadsheet with your total sales and your total costs. This small habit prevents the “January Panic” and ensures that if HMRC ever asks questions, you have the proof ready to go.

Staying legal with the side hustle tax uk 2025 rules isn’t about giving away all your hard-earned money; it’s about protecting your business from unnecessary fines. If you earn over £1,000, register today and keep your peace of mind.